5 Things We Learned This Week - 9/06/2025

Submitted by Silverlight Asset Management, LLC on September 6th, 2025

September 6, 2025

The S&P 500 rose 0.4% this week. The Bloomberg Aggregate Bond Index gained 1.0%, while Gold surged 4.1% and Bitcoin jumped 3.2%.

The ISM Manufacturing Index showed ongoing softness in the industrial economy, with August’s PMI holding in contraction territory at 48.7. Executives cited tariff headwinds and lingering policy uncertainty as key drags on growth and stability. Conversely, the ISM Services Index painted a modestly firmer picture, posting a third consecutive month of expansion at 52.0. Even so, pricing pressures were evident—respondents across sectors flagged rising input costs and increasingly cost-sensitive consumers. Meanwhile, the August Jobs Report confirmed that July’s weakness wasn't a one-off. The unemployment rate climbed to 4.3%, the highest since 2021.

The Economic Part of World War III May Have Already Begun

The stage was set in Beijing this week as an unprecedented display of military power unfolded at Tiananmen Square. China's President Xi Jinping presided over a massive parade commemorating the 80th anniversary of World War II's end, flanked by Russia's Vladimir Putin and North Korea's Kim Jong Un in their first-ever public appearance as a trio. The spectacle featured China's latest military hardware, including hypersonic missiles, underwater drones, and advanced fighter jets, while Xi warned that humanity faces "the choice of peace or conflict". This wasn't merely a historical commemoration—it was a bold statement of defiance against what these nations perceive as Western economic persecution.

The most intriguing moment occurred in the private confines of Putin's armored limousine. After the Shanghai Cooperation Organization summit, Indian Prime Minister Narendra Modi joined Putin for what was supposed to be a 15-minute ride that stretched to nearly 50 minutes. Putin later revealed he discussed "the negotiations in Alaska"—likely referring to his recent talks with Trump—but speculation abounds about other topics. Given India's recent punishment with 50% U.S. tariffs for purchasing Russian oil, energy policy and America's escalating trade war were almost certainly on the agenda. Modi's public hand-holding with both Putin and Xi sends an unmistakable signal about India's willingness to pivot away from Washington.

Trump's economic assault on BRICS nations appears to be backfiring. His administration has imposed punitive tariffs reaching 50% on India and Brazil, with China facing potential 145% tariffs. These measures are explicitly political, designed to force compliance with American foreign policy objectives. However, history suggests this strategy may prove counterproductive. As Ray Dalio has observed, "economic warfare precedes military warfare", and the pattern from World War II—where the Smoot-Hawley Tariff Act triggered global retaliation and worsened tensions—offers a sobering parallel.

Rather than submit to American pressure, BRICS nations are accelerating their efforts to build alternative financial systems. The bloc continues developing plans for a new reserve currency potentially backed by gold, while increasing bilateral trade in local currencies. Russia and China are already conducting substantial trade outside the dollar system, and even traditional U.S. allies are diversifying their currency reserves. Trump's threats of 100% tariffs on any nation attempting to bypass the dollar may have the unintended consequence of pushing these countries closer together, transforming what was once a loose coalition into a more unified anti-Western bloc.

The economic battle lines are being drawn. Seven billion people in the Global South now face a choice between Western economic dominance and emerging alternatives. For investors, these trends highlight the growing likelihood of a bifurcated global economy. Allocations insulated from dollar dominance—whether commodities, frontier market debt, or real assets—are an important hedge against this new era of economic warfare.

Why Is the Jobs Data So Bad, And How Should We Interpret It?

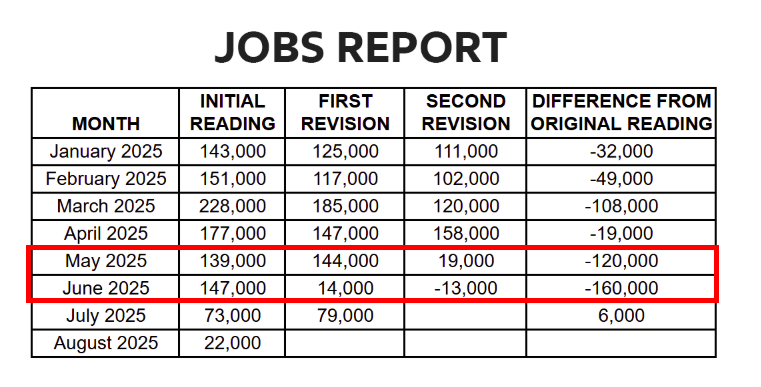

Every few weeks, investors circle the first Friday of the month for the Jobs Report—one of the most closely watched barometers of economic health. Yet recently, the bigger story hasn’t been the headline numbers. It’s been the revisions. Month after month, prior payroll gains have been quietly marked down—sometimes by hundreds of thousands of jobs.

In August, for instance, the Labor Department not only reported a rise in unemployment to 4.3%—its highest since late 2021—but also cut prior months’ job gains substantially. For example, after a second data revision, the U.S. went from "adding" 147,000 jobs in June 2025 to LOSING -13,000 jobs. These downward revisions matter because they suggest the labor market is cooling far faster than the initial data implies. The labor market drives consumption patterns, which is the biggest slice of the U.S. economy.

The leading theory for why jobs numbers are being revised so heavily is that the government’s initial payroll estimates are increasingly misaligned with real-time economic shifts. Early readings rely on survey data and statistical models that often overstate job creation during turning points in the cycle. As businesses cut hours, delay hiring, or quietly trim staff, those changes are missed in the first pass but show up later when more complete data—such as unemployment insurance records—are incorporated. In today’s environment of post-pandemic normalization, shifting labor participation, and widespread use of gig and contract work, the old models appear to be systematically too optimistic.

At Silverlight, we've taken recent signs of macroeconomic weakness as a cue to rebalance more toward defensive, economically-resilient sectors, such as Health Care, Utilities and Consumer Staples.

Taxpayer Funds Shouldn’t Bail Out a Fading Intel

Michael wrote an article for Forbes this week titled, "Washington Just Bought A Chunk Of Intel, But You Can’t Buy Innovation."

Washington’s new 9.9% stake in Intel will help the firm, but it isn't a shortcut to the ingenuity necessary to compete effectively in a globally competitive market. Only world-class engineering, yield improvements, and customer wins will revive Intel’s edge. Intel used to be a winner with dominant market share. Not anymore. It's reminiscent of many great American companies that eventually fell out of their prime. Take Sears, for example.

Article excerpt:

Sears limped into bankruptcy in October 2018. The company failed because it didn’t innovate, while Amazon built a superior technology and logistics stack, reinvested relentlessly, and made “Day 1” its innovation religion.

Government money probably wouldn’t have reversed the cultural and technological gap Sears was facing. At best, it would have only prolonged the failing structure.

Intel is not Sears, but parallels exist:

Platform transitions. Sears missed the web; Intel missed successive process nodes and the extreme-scale foundry model.

Allocation discipline. Sears optimized real estate and financial engineering while rivals optimized algorithms and UX. Intel must resist the temptation to optimize to Washington’s scorecard (domestic capacity, milestones, press releases) over global competitiveness (process leadership, price-performance, ecosystem wins).

Narrative vs. moat. Sears had a proud narrative, but Amazon had a compounding moat. Intel now has a powerful industrial policy narrative. Yet, the moat must still be earned—node by node, one design win at a time.

What if the government had propped up Sears?

If the U.S. government tried to help Sears, it would have delayed store closures and maybe saved some jobs—for a while.

It would not have built a cloud, a third-party marketplace, or a parcel network capable of two-day delivery.

Likewise, a government stake in Intel can underwrite capacity, but it can’t force competitive cost per transistor, or a sticky developer ecosystem. Those are innovation outputs of culture and technical leadership, not line items in an appropriations bill.

The Elon Premium: Analyzing Tesla's Trillion-Dollar Compensation Logic

On the surface, Elon Musk's proposed $1 trillion compensation package appears astronomical. But when measured against Tesla's current valuation premium, it kinda actually makes sense.

Here's why: Tesla currently trades over 12x sales, representing about a 28x premium over its traditional American automaker peers—GM and Ford—whose shares whose shares trade at only 0.3x sales. This valuation gap translates to about $1.09 trillion in what we can call the "Elon Premium," which is the portion of Tesla's market value that exists purely based on investors' faith in Musk's ability to deliver transformation technologies that stretch far beyond conventional automotive manufacturing.

If Tesla was valued similar to Ford and GM at 0.3x sales, the company's $1,16 trillion market cap would collapse to roughly $40 billion, wiping out 97% of shareholder value. In other words, Elon's unique ability to charm Wall Street into paying a nosebleed valuation has probably already earned a trillion dollars to Tesla shareholders.

To earn the future trillion dollar pay package, Tesla must achieve a $8.5 trillion market cap while hitting important operational milestones, such as 20 million vehicle deliveries, 1 million operational robotaxis, and 1 million AI bots. Lofty goals to go with a lofty pay package.

Quantum Leadership In Business and Life

This week, Silverlight's new Chief Wellbeing Officer, Dr. Stephen Sideroff, traveled to Guatemala to attend the Volcano Innovation Summit. He chaired a panel discussion titled, "Quantum Leadership: Leadership to Meet the New Realities of an Interdependent World."

Quantum Leadership is the art of leading with awareness, adaptability, and presence in a world defined by uncertainty. Drawing inspiration from quantum physics, it embraces complexity and paradox rather than resisting them. Dr. Sideroff, a pioneer in this field, blends psychology, neuroscience, and resilience research to teach that effective leadership is less about control and more about alignment—with oneself, with others, and with the larger system we inhabit. His philosophy emphasizes flexibility, emotional regulation, and the ability to reset in the face of stress.

Practicing quantum leadership doesn’t require a boardroom. We can apply it in our everyday lives by pausing before reacting, reframing challenges as opportunities, cultivating empathy in conversations, and choosing long-term harmony over short-term wins. Basically, it’s about leading your own life with clarity and resilience.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX