5 Things We Learned This Week - 11/2/2025

Submitted by Silverlight Asset Management, LLC on November 2nd, 2025

November 2, 2025

The S&P 500 rose 0.7% this week. The Bloomberg Aggregate Bond Index declined 0.6%, Gold fell 2.5% and Bitcoin shed 0.8%.

Economic news was sparse this week as the government shutdown remains in effect. The Dallas and Richmond Fed manufacturing surveys showed deceleration in both regions with falling new orders. Pending home sales stayed flat despite lower mortgage rates, with activity subdued. The Federal Reserve cut interest rates by a quarter point to support employment, but signaled this could be its last move for a while.

Argentina Rejected Socialism, Will New York City?

Argentina—a nation long defined by Peronist socialism and economic mismanagement—has just rebuked central planning. President Javier Milei’s coalition recently scored a decisive victory, signaling strong support for his libertarian, market-oriented reforms.

Meanwhile, New York City—the financial capital of the world’s most successful capitalist economy—may soon elect a democratic socialist mayor. As hedge fund titan Bill Ackman noted on X, “Argentina rejects socialism while NYC embraces it. The world is upside down.”

That inversion is worth examining. Polls show democratic socialist Zohran Mamdani leading former Governor Andrew Cuomo 48% to 32%, with prediction markets giving him over a 90% chance of victory. The fact that socialism now commands majority support in America’s largest city is troubling, because it ignores the principles that built U.S. prosperity.

Argentina’s shock therapy of spending cuts, deregulation, and privatization has already halved inflation and produced its first budget surplus in over a decade. New York, by contrast, is flirting with socialist ideas like rent freezes, free transit, and new city-run enterprises—policies that often promise compassion but deliver stagnation. Capitalism, rooted in incentive and innovation, remains history’s most reliable engine of abundance. Though Americans make up only 4% of the global population, they generate 25% of global GDP. This doesn't happen through central planning, but through free enterprise.

Advocates of socialism often cite the Nordic model as proof that “socialism can work.” Yet Sweden, Denmark, and Norway are capitalist at their core—anchored by strong property rights, vibrant private sectors, and high but transparent taxation. In 2025, GDP per capita stands at $90,320 for Norway, $71,967 for Denmark, $59,508 for Sweden—and $89,678 for the U.S. Americans match Norway’s output while facing far lower tax burdens: 27.7% of GDP versus over 41% across the Nordics. In short, Americans keep more of what they earn and achieve similar prosperity.

Milton Friedman warned that prioritizing equality over freedom yields neither. As New Yorkers head to the polls, they face a clear choice: preserve the dynamism of capitalism—or repeat the mistakes others are now trying to undo. Treasury Secretary Scott Bessent put it bluntly: if Mamdani enacts his agenda, “New York City will soon be asking Washington for a bailout.”

Mega Caps Are Spending A Lot Of Money

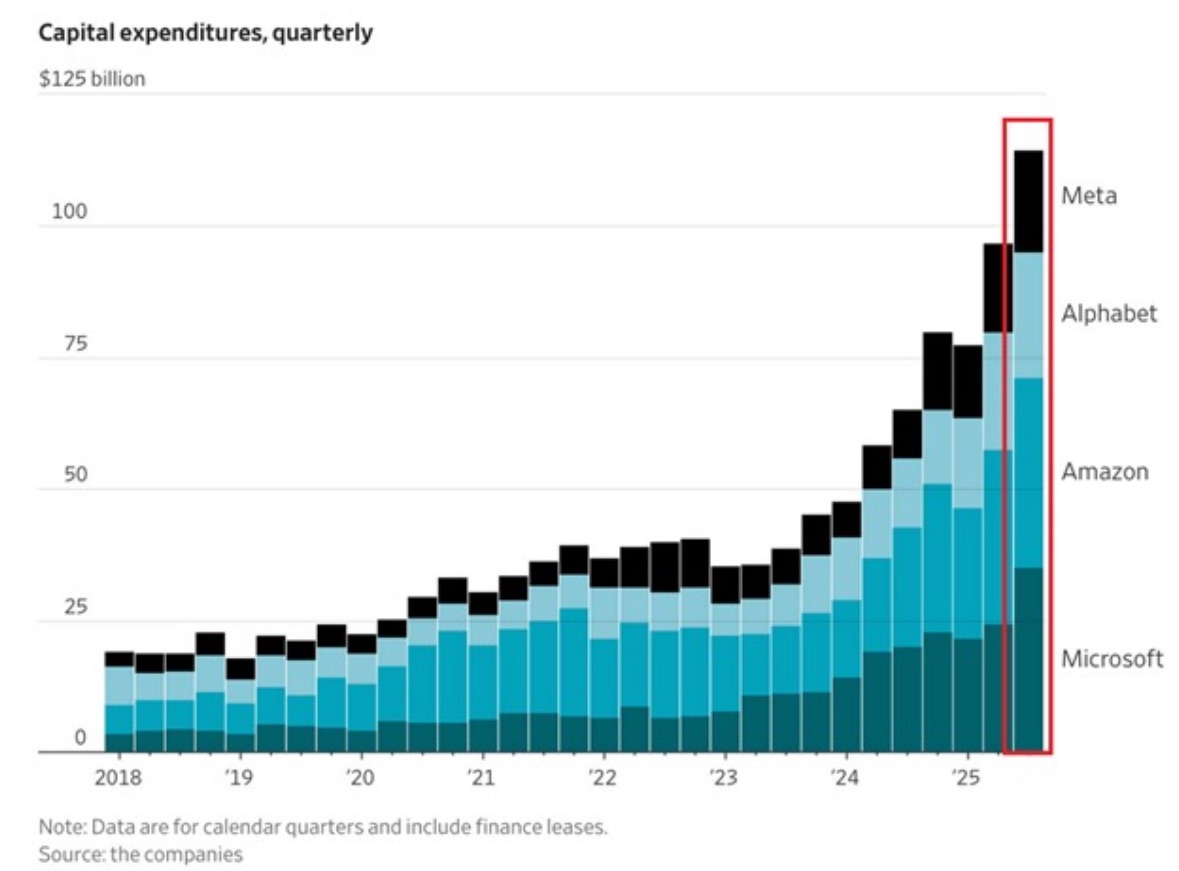

Earnings season has once again showcased the sheer financial might of Big Tech. Microsoft, Amazon, Alphabet, and Meta reported earnings this week, delivering robust top-line numbers and solid profitability. Another key focus of the earnings calls was how much these companies are spending. It's a lot.

Collectively, these hyper-scalers plowed a record $112 billion into CapEx last quarter. And they’re not slowing down: every firm plants to ramp up spending even more next year. The reason? The AI infrastructure race is real and accelerating. Billions are flowing into new datacenters, chips, and the physical backbone of the future digital economy.

History urges caution. A recent analysis by Morningstar shows that companies aggressively growing their asset base through high capital spending have underperformed their more conservative peers by 8.4% annually from 1963 to 2025, across sectors and geographies. This underperformance is considered the "asset-growth anomaly" in finance literature.

But what about those firms receiving the funds? Much of Big Tech’s capex filters directly into the coffers of companies residing in the energy, materials, industrials, and utility sectors. Interestingly, those sectors trade at P/Es of 16.5, 22.7, 27.8 and 20.8 respectively, while the "spenders" from the Mag 7 trade at a P/E of 39.5.

Why Value Investors Can't Win

In March 2022, JPMorgan Asset Management wrote, "Value investing remains a lonely place. Around the world, the proportion of equity assets invested with Value managers has fallen to 5%-10%."

Ironically, the title of the note was, "Value vs. Growth Investing: Value Returns With a Vengeance." The comeback was short-lived. Since that note came out, the Russell1000 Value Index has gone up 33% while the Russell 1000 Growth Index rallied 80%.

At this point, you have to feel bad for value investors. Their style has been out of favor for twenty years. Buying cheap securities just because they are cheap doesn't pay off like it used to. There's a reason for this, however: Value investors are stuck in the minority.

Whether the value share of the market is 10% or 15% doesn't really matter. What matters is this group of people who like to buy cheap stocks are vastly outnumbered by the tribe of investors who chase other factors, like growth and momentum. Today, over half of the U.S. equity market is comprised of passive investors who automatically buy the biggest companies trading at the richest prices. They don't do any analysis about valuation. Neither do most retail investors, which is another large and growing cohort that systematically fades the main traits value investors look for in a security.

Think of it this way: would you expect a 5-person football team to beat an 11-player squad? That's why value investors can't win. They're systematically outnumbered.

Markets are ruled by supply and demand forces, and there just aren't enough value investors left to generate the collective bid required for a sustainable bullish turn. That can only happen when the passive share of the market begins to reverse.

First Solar Investment Thesis

First Solar’s latest quarterly earnings beat expectations, sending FSLR shares sharply higher this past week. The company’s revenue, margins, and guidance all exceeded analyst forecasts, with a positive surprise driven by robust customer demand and higher pricing power in a tightening solar module market. Investors welcomed strong bookings momentum and an expanding pipeline, reinforcing confidence in First Solar’s growth outlook.

Founded in 1999, First Solar manufactures advanced thin-film solar panels, specializing in cadmium telluride technology. Its main strengths lie in proprietary manufacturing, low-cost and U.S.-based production, and industry-leading scale-up speeds. First Solar is one of the few domestic suppliers with products exempt from tariffs, providing a key advantage as utility-scale solar procurement accelerates.

EIA expects U.S. solar generation capacity to rise 60–70% by 2035. However, this estimate may understate future demand: AI data centers and electrification could increase U.S. power demand by 15–20% over the next decade—with the upper bound becoming likelier as robotics adoption expands. FSLR’s multi-year contracted backlog is growing rapidly, positioning it as the leading, fastest-to-scale solar technology provider in North America.

Hope: The Cornerstone of Emotional Wellbeing

In 2019, bushfires destroyed dozens of small businesses across New South Wales. One of them was Becky's Bakes, a home bakery in Cobargo. According to the Sydney Morning Herald, owner Rebecca Hinds rebuilt from scratch with community help and reopened a year later. “Hope kept me going,” she told reporters. “You can’t rebuild without it.”

A groundbreaking study in Health Economics, analyzing over 25,000 Australians via the HILDA survey, reveals hope as the most influential positive emotion—outpacing happiness or safety.

Hopeful people are more adaptable to setbacks, less lonely, and take better care of their physical health. They tend to focus more on internal things they control rather than external stuff they can't, which reduces stress. Hope also encourages people to take more action in pursuit of their goals, which makes them more productive.

To cultivate more hope for yourself, try these science-backed tips:

First, map your “pathways”—list three alternative routes to a stalled goal. Data links this cognitive strategy to 18% higher life satisfaction.

Second, schedule weekly “hope huddles” with a trusted friend. Research shows intentional social accountability doubles goal persistence.

Third, use the “future self” letter technique—write a detailed note from victories achieved a few years from now. Randomized trials have shown this exercise spikes perceived personal control by 22%.

So go ahead and move beyond wishful thinking. Engineer more optimism and hope into your life and see what happens next.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX