5 Things We Learned This Week - 10/26/2025

Submitted by Silverlight Asset Management, LLC on October 26th, 2025

October 26, 2025

The S&P 500 rose 1.9% this week. The Bloomberg Aggregate Bond Index gained 0.2%, Gold fell 3.0% and Bitcoin rallied 3.9%.

This week’s economic data gave investors a cautiously upbeat view of the U.S. economy. September’s CPI rose 0.3% month-over-month and 3.0% year-over-year—slightly below expectations—bolstering hopes for another Fed rate cut soon. Existing home sales climbed 1.5% to 4.06 million, matching forecasts and marking their best pace in seven months. Meanwhile, October’s PMI readings surprised to the upside: manufacturing rose to 52.2 and services to 55.2, the strongest composite since July. Markets interpreted the combination of cooling inflation and resilient activity as reinforcing a “soft landing” scenario.

What If Tariffs Are Overruled?

In our view, the most overlooked story in markets right now is the high potential for President Trump’s tariff policy to be overturned by the Supreme Court.

In the high-stakes world of prediction markets, Polymarket traders are betting big on the court's potential smackdown of tariffs. As of this writing, the odds sit at about 59% that the Court will rule against the administration's trade barriers, implying a 41% chance they'll uphold them.

If the justices strike down these tariffs, expect a massive market bounce—perhaps 5-10% across major indices in the short-term. Global supply chains would likely breathe easier and corporate earnings would get a boost. It could also spark an inflationary boom if pent-up demand fuels consumer spending and rising commodity prices.

On the diplomatic front, Treasury Secretary Bessent and President Trump would have serious egg on their faces if the tariffs go bye bye. The administration has touted these measures to foreign leaders as ironclad. Being overturned by the court would be a level of embarrassment that could present a whole new array of geopolitical risks. Trump may turn a different level of orange and have steam coming out of his ears. But we can punt that hypothetical discussion for another day.

Sectors poised to thrive if tariffs go away? Look to consumer discretionary, technology, and manufacturing. Firms like Amazon, Apple and Caterpillar could see a nice margin lift if import price headwinds abate.

Prediction markets like Polymarket don't always get forecasts right, but they have a solid track record on Supreme Court calls. Past cases, from immunity rulings to regulatory challenges, show accuracy rates above 70%.

The Court is slated to take up the case with oral arguments around November 5, 2025. We will monitor this development closely and report back as the story evolves.

Is Gold's Epic Run Over, Or Just Taking A Break?

After soaring to a record $4,380 per ounce earlier this month, gold has since fallen about 6% as investors took profits amid easing geopolitical tensions and a firmer dollar. That pullback spooked some, but let’s keep perspective: gold remains up nearly 56% year-to-date. Nothing goes up in a straight line, especially at that pace.

The real driver behind the gold bull market isn’t retail speculation or FOMO—it’s central banks. Global central banks have been voracious buyers, led by China, which has quietly added over 300 tons to its reserves this year alone. Numerous countries appear to be seeking diversification away from the U.S. dollar, and that trend isn’t likely to reverse anytime soon. With mounting debt and geopolitical fragmentation, gold still plays the role of monetary ballast.

Emerging-market BRICS nations are testing a monetary framework called BRICS Pay—a cross-border digital payment platform enabling oil and commodity trade in local currencies rather than U.S. dollars. Organized by the expanded BRICS-11 bloc (including Brazil, Russia, India, China, South Africa, and key oil producers like Saudi Arabia and the UAE), BRICS Pay aims to bypass Western systems like SWIFT. Several member states are exploring a gold-backed currency concept, sometimes called the “BRICS Unit,” designed to anchor trade settlement in a tangible asset rather than fiat. While the rollout is still exploratory, the logic is strategic: by linking future monetary frameworks to gold or commodity reserves, BRICS nations can increase confidence in cross-border trade.

We will turn bearish gold someday. It will probably be after retail demand spikes to euphoric levels, which is a classic contrarian signal. We aren't seeing euphoria now; physical gold held in U.S. listed ETFs like GLD remains below 2022 peaks, despite recent inflows. Currently, gold comprises just 4% of global wealth, far from the 22% peak in the early 1980s. This suggests plenty of runway for Costco shoppers to load up on more gold bars and push the gold price higher. Silverlight clients are long gold via GLD and several individual gold mining companies.

How Much Screen Time Is Too Much For Kids?

How much time should kids spend on modern tech devices? As parents, we’ve asked ourselves this question often. Opinions vary, so we looked into how Silicon Valley’s elite handle it at home.

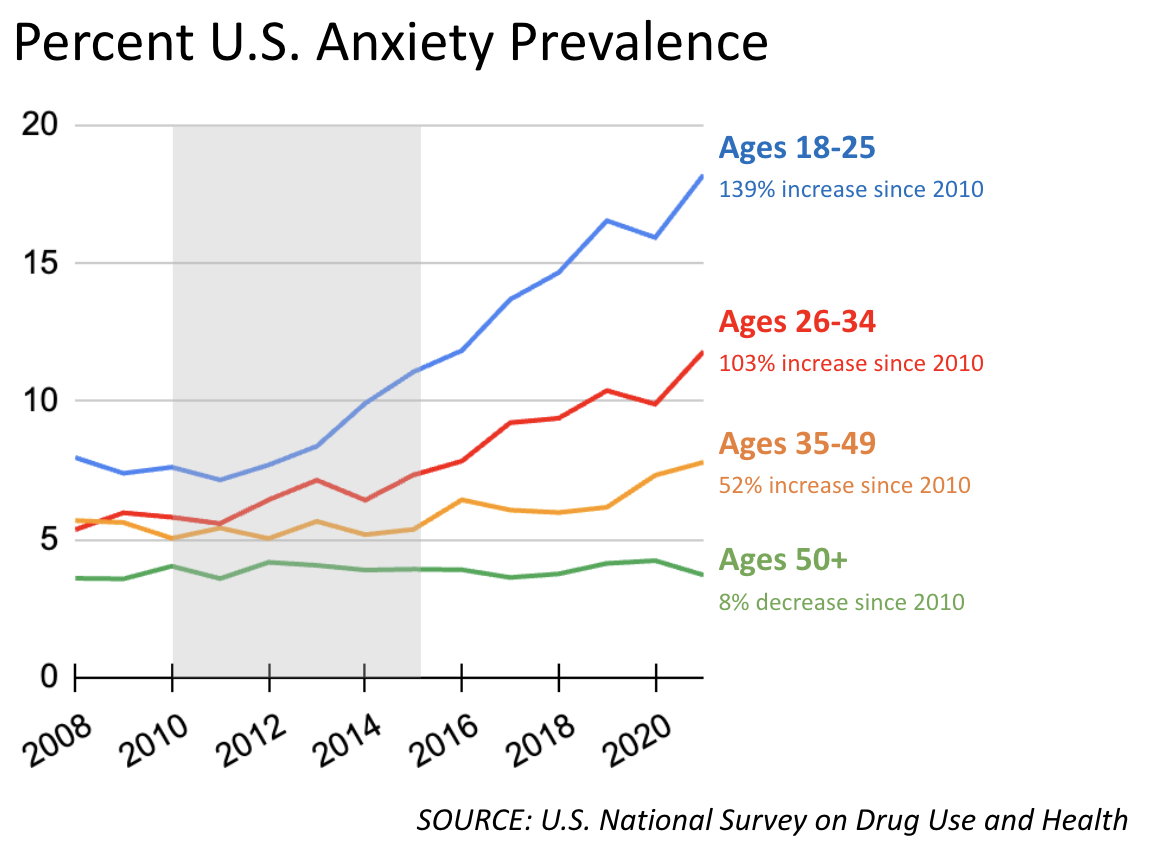

Ironically, many tech visionaries strictly limit their own children’s screen time! They understand the double-edged nature of connectivity—it's empowering yet addictive. Research, including Jonathan Haidt’s The Anxious Generation, warns that today’s parents overprotect kids in the real world but under-protect them online.

The trend toward tech elites putting on restrictions may have begun with Apple co-founder Steve Jobs, who told The New York Times, “We limit how much technology our kids use at home.” Bill Gates delayed smartphones until age 14 and capped gaming at 45 minutes, saying "tech should be a servant, not a master." Snapchat’s Evan Spiegel allows just 90 minutes of weekly screen time focused on “wholesome content.”

Some go even further: former Facebook executive Chamath Palihapitiya bans social media entirely. Google founders Sergey Brin and Larry Page enrolled their kids in the tech-free Waldorf School, which discourages screens to foster more creativity and attention.

These choices reveal a striking irony—the creators of our digital world are among its most cautious parents. Perhaps we should all take a cue from that?

How Much Income Makes Someone Financially Successful?

Since 2020, inflation has averaged over 5% annually, far exceeding the Federal Reserve's 2% target. This persistent price surge has left most Americans feeling like their dollars buy less—from groceries to gas. Purchasing power has eroded across the board.

Yet, a recent X post by @profplum99 highlights a stark generational divide in perceptions of financial success. The chart shows Boomers (born 1946-1964) believe around $100,000 in annual income suffices, while Gen Z (born 1997-2012) pegs it at over $500,000. Huge spread. In reality, only about 1% of U.S. households earn over $500,000 per year.

Nobody should feel like a financial failure just because they aren't in the top 1%. Gen Z clearly needs a wake up call.

Gen Z’s perception gap may stem from growing up in the social media age, where influencers regularly flaunt luxury lifestyles that are aspirational but statistically rare. Meanwhile, the cost of adulthood has never been steeper, which Gen Z feels acutely. Gen Z faces the heaviest student loan burdens of any generation, paying on average $526 per month. Soaring housing costs aren't helping young folks, either. The median first-time homebuyer age is now 38, up from 31 in 1981. It's much harder for young people to form households nowadays without a high-paying job, so maybe that's why they think they need to make half a million dollars to get ahead.

Ultimately, there's no magic number for feeling "rich." Financial success is deeply personal. The right income is whatever amount funds your most important lifestyle and legacy goals on time with confidence.

Baker Delivers Free Birthday Cakes To Homeless People

Homelessness in America has surged, climbing 18% in 2024 to over 770,000 people—the highest on record. That's a 33% jump from 578,000 a decade ago, driven by soaring housing costs and economic pressures.

Yet, in the shadows of this debilitating trend, glimmers of compassion emerge—like Charlotte baker Manolo Betancur's heartfelt mission.

Twenty-five years ago, Manolo immigrated penniless from Colombia to Tennessee for college, learning English from scratch. After marrying and relocating to North Carolina, he launched Manolo's Bakery in 2005, becoming the Carolinas' oldest immigrant Latino spot. The restaurant is famed for its tres leches and cheesecakes.

Twelve years ago, Manolo started giving away birthday cakes to his unhoused neighbors. "We don't call them 'homeless'—they're our neighbors," he insists. Inspired by his own humble start, Manolo donates vanilla sheet cakes to mark birthdays, "Nobody thinks about their birthdays," he says.

This year marked his 300th donated cake, but one in particular stands out. A nonprofit worker shared with Manolo how a recipient wept, confessing it was the first birthday cake he ever received. "That was the most important cake in this bakery," Manolo said.

Manolo isn't the only one doling out kindness. In New York City, hairstylist Mark Bustos offers free Sunday haircuts to unhoused folks, boosting their self-confidence and restoring dignity one snip at a time.

Want to make a difference like Manolo and Mark? Think about what work, interests or hobbies are second-nature to you. Maybe one of those gifts is an opportunity to lift someone up who needs it.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX