5 Things We Learned This Week - 1/04/2026

Submitted by Silverlight Asset Management, LLC on January 4th, 2026

January 4, 2026

The S&P 500 fell 1.0% this week. The Bloomberg Aggregate Bond Index shed 0.2%, Gold fell 4.4%, and Bitcoin rallied 2.7%.

This week’s data reinforced a familiar theme: the U.S. economy is slowing, but not stalling. Pending home sales bounced modestly, though the recovery remains uneven beneath the surface. Manufacturing, particularly in Texas, is still soft, with firms trimming hours rather than headcount. That distinction matters, and it helps explain why overall jobless claims remain historically low. The latest FOMC minutes reflected a Fed that’s cautious, data-dependent, and still biased toward further easing in 2026.

The US Invaded Venezuela For Economic Reasons

The United States has just carried out one of the most dramatic regime-change operations in modern history, striking Venezuela and capturing President Nicolás Maduro in an overnight raid that Trump says will allow Washington to “run the country” until a new leadership is installed. For a nuclear-armed superpower to physically remove a sitting head of state and openly claim interim control is extraordinarily rare, even by the standards of past U.S. interventions.

Officials are framing the operation as a response to narco‑terrorism and dictatorship. However, Venezuela is at most a minor node in the U.S. drug pipeline compared with Colombia and the Mexico corridor, which handle the overwhelming majority of cocaine and fentanyl flows. Nor does this appear primarily about defending democracy: Washington maintains deep security and energy ties with Saudi Arabia, an absolute monarchy with no national elections.

The real stakes are economic. Venezuela holds roughly 303 billion barrels of proven oil reserves, about one‑fifth of the world’s total and the largest on Earth, along with substantial deposits of gold, iron ore, bauxite, gas, and other critical minerals. In an era when AI, data centers, and electrification are intensifying demand for energy and resource security, control over such an outstanding resource base is a strategic prize. Similar logic explains Trump’s long‑standing interest in resource‑rich territories like Greenland.

Another fault line is the petrodollar. Since the 1970s, dollar‑denominated oil trade has underpinned global demand for U.S. currency and helped cement American financial hegemony. Maduro’s government had been experimenting with non‑dollar settlements, deepening ties with China and Russia and signaling interest in arrangements that use yuan or other currencies for energy exports. Those moves paralleled a broader trend in which Russia, Iran, and several BRICS economies have promoted de‑dollarized payment systems and alternatives to SWIFT. Analysts have long noted that leaders who pushed too aggressively against the petrodollar—such as Saddam Hussein after discussing euro pricing and Muammar Gaddafi’s flirtation with a gold‑backed African currency—found themselves on the wrong side of Western regime‑change campaigns, even if the official justifications centered on weapons or humanitarian concerns.

For investors, the bullish case is a world where U.S. companies will gain privileged access to Venezuelan oil, metals, and infrastructure, supporting upside in oilfield services, shipping, defense, and industrials tied to rebuilding and extraction. The bear case is that a precedent of overt regime change over resource and currency issues could accelerate de‑dollarization, invite Chinese countermoves toward Taiwan, and increase the tail‑risk of a great‑power confrontation.

Silverlight's Economic Outlook: First Fire, Then Ice

Economic “fire and ice” means the economy first gets too hot, then too cold. When prices race higher (fire), people and governments borrow and spend a lot, but those same high prices later squeeze wallets, cool spending, and can flip the economy into falling prices and slower growth (ice).

Today’s stock market is heavily tilted toward tech: Information Technology represents about 35% of the S&P 500 index. Meanwhile, old‑economy sectors like Energy and Materials only constitute about 5% of the S&P 500. That allocation schematic creates an awkward balance going forward, because AI data centers devour copper, silver, and many other commodities. AI can't work without huge investment in resource‑heavy industries.

In 2025, silver, gold, and copper surged and beat the S&P 500. This year, we expect commodities to stage an encore performance. With midterms approaching, Washington is likely to favor more fiscal stimulus and easier money, stoking another bout of inflation and supporting risk assets. But hotter prices will eventually invite a harsher Federal Reserve stance and tighter budgets, which usually leads to a deflationary cooling off phase.

Investors can lean into this classic cyclical pattern by first overweighting sectors that are likely inflation winners—Energy, Materials, and Industrials—then rotating into classic defensive sectors such as Consumer Staples, Health Care, and Utilities as conditions cool. Passive investors anchored to today’s tech‑heavy S&P 500 index are poorly positioned for both of these leadership shifts. The mega cap stocks that dominate the S&P 500 will probably levitate higher in the bull phase, but underperform badly once deflation arrives. That may not be until 2027, but we'll continue to monitor and report on these dueling macro trends as the year evolves.

Real Estate Faces Mortgage Rate Headwinds

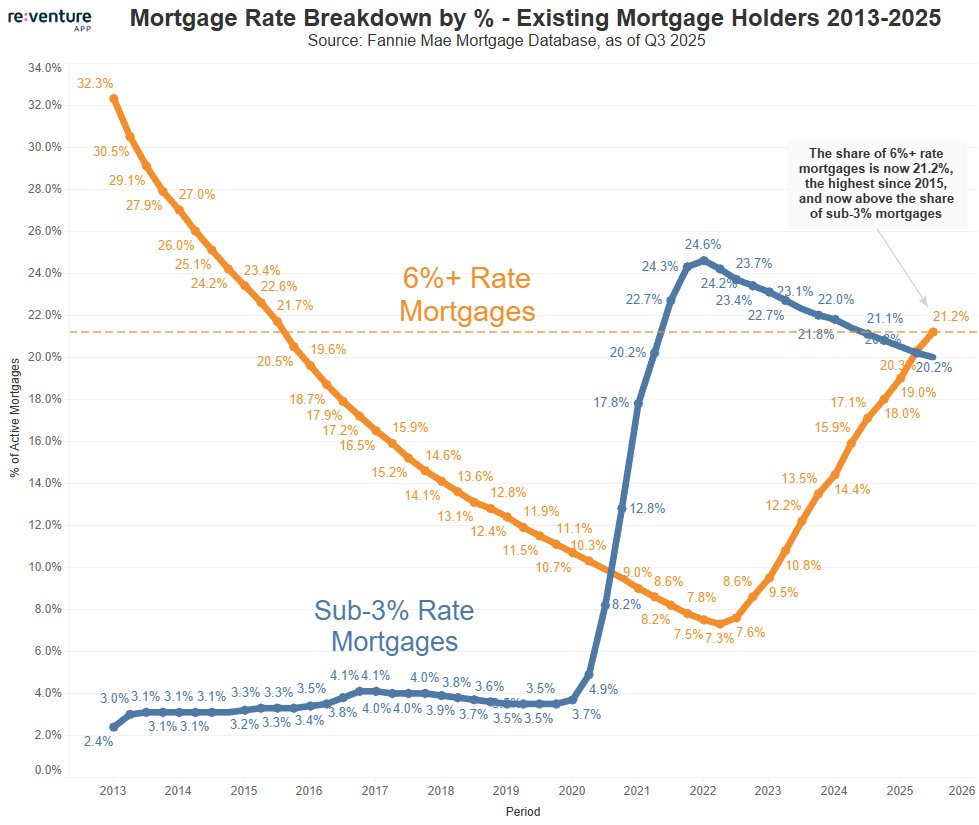

As we head into 2026, the U.S. housing market has quietly crossed an important threshold. For the first time since the pandemic, more homeowners now carry mortgage rates of 6% or higher than sub-3% loans.

That shift matters. It marks the gradual fade of the “mortgage rate lock-in” that kept would-be sellers frozen in place. By the end of 2025, 21% of mortgages sat in the 6%+ bucket—the highest share since 2015 and nearly triple the pandemic low. So, a lot more homeowners now hold mortgages similar to today’s interest rates, which means selling no longer feels like financial self-sabotage.

Each year, roughly 5–6 million new mortgages are being written at these higher rates, even with muted sales and refinancing activity. Over time, that math points to more listings and a slow but steady rebuild of housing inventory. More supply has consequences. It creates a headwind for home prices by shifting leverage away from sellers and back toward buyers. Moreover, the cost to own versus rent is wildly out of balance. Across major U.S. metros, average mortgage payments are about 38–50% higher than rents. That gap is historically extreme. As new supply comes online and rents flatten in many cities, landlords and highly leveraged buyers lose pricing power. History suggests that’s not a friendly setup for home values.

Chewy Thesis To Own

Chewy (CHWY) has built a simple but powerful business: be the default destination for pet parents. Through a digitally native platform focused on convenience, value, and service, Chewy delivers food, medications, supplies, and an expanding set of pet-health offerings. Its Autoship model sits at the center of the strategy, driving predictable, recurring revenue as customers rely on Chewy for everyday essentials.

Chewy is a high-quality firm growing at a healthy pace. In Q3 FY25, net sales rose 8% year over year to about $3.1 billion, while Autoship revenue grew roughly 14% and now represents ~84% of total sales. Net sales per active customer climbed 5% to ~$595, and the customer base expanded to 21 million—evidence of rising wallet share and category leadership. Profitability is following: gross margin improved to 29.8%, adjusted EBITDA grew more than 30%, and operating leverage is improving as higher-margin subscriptions and services like Chewy Vet Care scale.

The stock, however, tells a different story. Shares sold off last year as investors rotated away from former pandemic winners and multiples compressed to more ordinary levels. With management raising FY25 revenue and margin guidance, expectations now reset, and consensus pointing to high-single-digit revenue growth and double-digit EPS growth in 2026, Chewy looks like a quality compounder priced with modest assumptions. A recent cluster of DeMark buy signals across multiple timeframes reinforced the fundamental setup, and we recently initiated a new position in Silverlight managed portfolios.

How To Plan Your Next Chapter In 2026

2026 can be the year you stop running someone else’s script and become the author of your next chapter. The stories you tell yourself about who you are will shape what you notice, what you attempt, and how bravely you follow through.

Start by writing a one-page narrative about overcoming a specific challenge in health, money, work, or relationships—the area that would most elevate your wellbeing. Then apply goalsetting best practices: set a clear edge (what you’ll do differently), focus on a few high‑leverage goals, turn them into daily repeatable actions, track your progress weekly, and keep compounding small wins over time.

Psychology Today notes that tiny, consistent wins and identity-based resolutions (“the kind of person who…”) are far more sustainable than vague wishes. You can use positive, future‑focused storytelling in a daily journal to rehearse this upgraded identity. Let this year become your bridge from intention to lived reality. Shifting self-talk from “I can’t” to “I’m learning to…” supports motivation, resilience, and long‑term mental health. Here are practical examples you can easily adapt to fit your circumstances.

Work and Achievement

“I’m always behind” → “I’m prioritizing what matters most with the time and energy I have today."

“I failed again” → “This is one data point helping me learn how to succeed next time.”

Health and Habits

“I have no discipline” → “I’m becoming the kind of person who keeps one small promise to myself each day.”

“I blew my routine, so why bother?” → “A single slip is feedback, not my identity; I restart with the next choice.”

Relationships and Self-Worth

“People don’t really like me” → “I’m learning to find and invest in people who appreciate me.”

“I’m too broken to change” → “I am a growing, imperfect human building a new chapter, one conversation and boundary at a time.”

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX